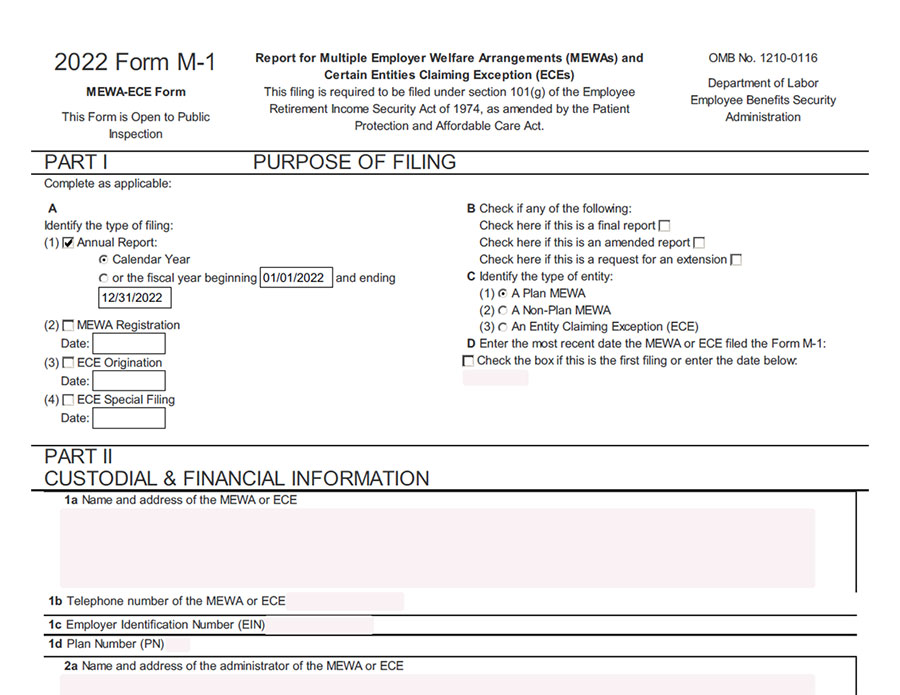

Form M-1 is a report that must be filed annually by Multiple Employer Welfare Arrangements (MEWAs) with the U.S. Department of Labor (DOL). A MEWA is a type of employee benefit plan that provides health and other benefits to employees of two or more unrelated employers.

The information on the form provides the DOL with information about the MEWA, such as its financial condition, the number of employees or participants, and the types of benefits provided. The primary purpose of the form is to help the DOL monitor MEWAs and ensure that they are operating in compliance with federal law.

Form M-1 must be filed electronically on the Department of Labor’s Form M-1 Online Filing System website.

Who Must File Form M-1?

Multiple employer welfare arrangements (MEWAs) include arrangements that provide medical, surgical, hospital care, sickness, accident, disability, death, or other benefits. More specifically, these types of benefit plans include health insurance plans, dental and vision plans, and life insurance plans that are offered through the MEWA. However, only MEWAs that provide medical benefits are required to file Form M-1.

For example, MEWAs that provide only life insurance, certain types of disability insurance, or certain types of workers’ compensation would be exempt from the filing.

Additional exceptions for filing Form M-1 include a MEWA which is:

- A plan licensed or authorized to operate as a health insurance issuer in every state in which it offers or provides coverage for medical care

- A church plan, as defined by federal law

- A governmental plan, as defined by federal law

- A plan maintained solely for the purpose of complying with workers’ compensation, unemployment compensation, or disability insurance laws

- A plan maintained solely for the purpose of providing benefits to employees receiving coverage who are members of a collective bargaining unit

- A plan with two or more employers with at least 25% common controlling interest at any time during the plan year – using principles similar to IRC Section 414(c)

- A plan that provides coverage to employees of two or more employers due to a change in control – assuming temporary in nature and not for avoidance of M-1 filing

- A plan providing coverage to persons who are not employees or former employees such as nonemployee members of the board or directors or independent contractors – if not more than 1% of the total number of employees or former employees.

We can help you evaluate your plan and maneuver through the intricacies and make the right determinations.

What About Association Health Plans (AHPs)

Association Health Plans (AHPs) are a type of health insurance arrangement that allows small businesses to merge with another plan to purchase health insurance for their employees. They allow businesses to bond together based on a shared profession, line of business or geographical region in order to access health insurance savings associated with larger group medical coverage. Those AHPs described in the DOL’s June 21, 2018 final rule are MEWAs, subject to the Employee Retirement Income Security Act (ERISA) and are required to file Form M-1 and Form 5500, regardless of the plan size or type of funding.

Deadlines, Common Mistakes and Failure to File

Form M-1 must be filed annually by MEWAs with the DOL. The due date for filing Form M-1 is no later than March 1 following any calendar year for which a filing is required. An extension for an additional 60 days (until May 1) can be requested. No additional extensions are available.

There are other events which require additional M-1 filings – such as, but not limited to beginning operations or merger with another MEWA and may take place in the same year as the annual filing. There are varying due dates for these special event filings – such as 30 days prior to starting to operate the MEWA or within 30 days of other events.

Common mistakes include:

- Late filing

- Incomplete or inaccurate information

- Misidentifying the MEWA

- Missing attachments

- Failing to comply with state and federal laws

Failing to file Form M-1 in a timely manner or submitting inaccurate information can result in significant consequences for both the MEWA and its participants.

- Civil penalties of up to $1,881 per day (adjusted annually) until the form is filed

- In addition, the Department of Labor may take enforcement action against the MEWA, which could include fines, injunctions, and even criminal charges

- Inaccurate or incomplete information can also result in penalties and enforcement actions up to $1,881 per day (adjusted annually) for each violation of the reporting requirements

- Knowingly or recklessly providing false information may result in additional penalties

In the end, inaccurate information can also harm participants as it may result in the denial or reduction of benefits. Ultimately if the MEWA is found to be operating in violation of federal law, it may be required to cease operations, leaving participants without access to the benefits they were promised.

Benefits of a Preparation Service

Using a preparation service for filing Form M-1 can have several benefits, including:

- Expertise and knowledge that helps ensure the form is filed accurately and in compliance with federal law

- Timesaving since this can be a time-consuming process

- Peace of mind knowing that the form is being prepared accurately and on time

- Reducing the risk of penalties and enforcement actions

- Cost-effectiveness compared to the potential costs of penalties or enforcement actions resulting from inaccurate or late filings

Overall, using a preparation service for filing Form M-1 can be a valuable investment for MEWAs that want to ensure compliance with federal regulations and minimize the risk of penalties and enforcement actions.

Why Choose Us?

With offices from coast to coast, 5500Tax Group’s exclusive focus is on employee benefit tax compliance issues and regulatory changes. As highly qualified CPAs in good standing with decades of experience, our team of experts is well-versed in the latest regulatory reporting requirements and is dedicated to providing you with comprehensive and accurate Form M-1 preparation.

Our commitment to you is accuracy, timeliness, and customer satisfaction which ensures that your filing experience is as seamless as possible. Click here to learn more.

Contact us today to learn more about how we can assist you with your Form M-1 filing needs!