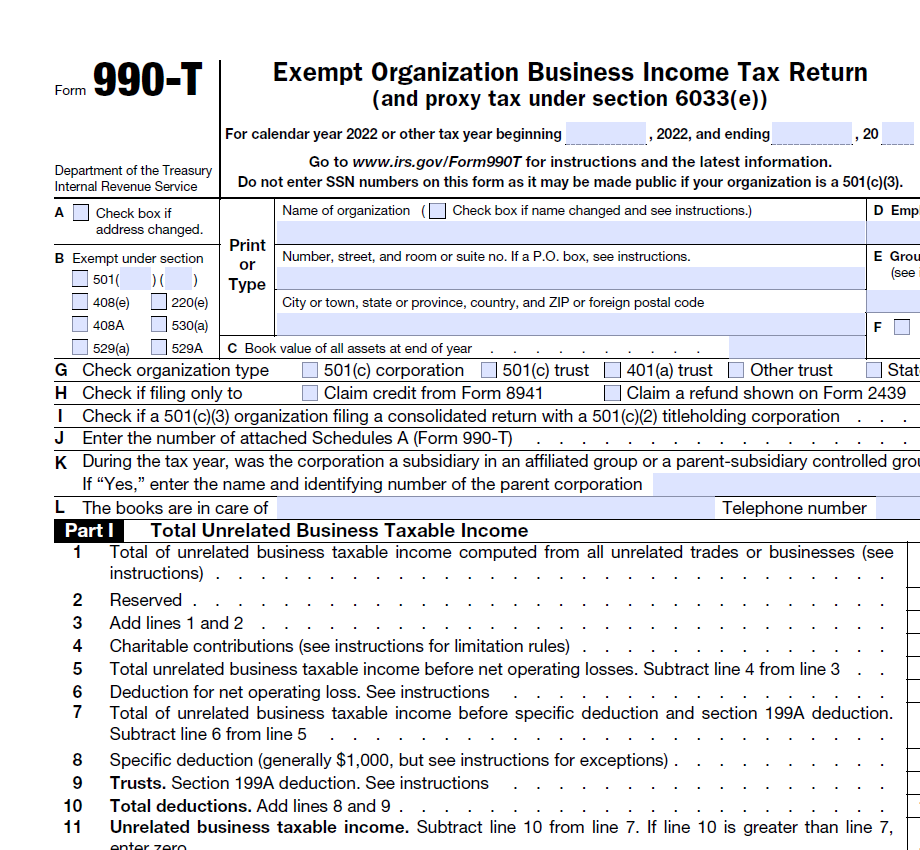

Unlike Form 990 (link to B6) which is NOT used to calculate taxes owed by the organization, IRS Form 990-T is a separate tax form that must be filed by tax-exempt organizations that have certain types of unrelated business income and is used to calculate and report tax owed.

What is Form 990-T?

Form 990-T is known as the Exempt Organization Business Income Tax Return or the Unrelated Business Income Tax or UBIT. This IRS tax form is used by tax-exempt organizations in the United States to report and pay federal income tax on unrelated business income.

The tax-exempt organization needs to file Form 990-T if they have gross unrelated business income of $1,000 or more during the tax year. The UBIT rate is determined by the federal corporate income tax rates, which may vary depending on the amount of taxable income and any applicable tax law changes.

Ultimately this allows the Internal Revenue Service (IRS) to monitor and regulate the activities, ensuring that they do not engage in excessive unrelated business activities that could compromise their tax-exempt status. This is done by maintaining transparency and accountability, demonstrating that they are using their resources primarily for their exempt purposes.

Unrelated Business Income Tax Criteria

UBIT ensures that tax-exempt organizations pay taxes on income derived from activities that are not directly related to their exempt purposes. The primary objective is to create a level playing field between tax-exempt organizations and their taxable counterparts, preventing them from having an unfair advantage in business activities unrelated to their exempt purposes.

There are three criteria that an activity must meet to be considered unrelated business income and subject to UBIT:

- The activity constitutes a trade or business, meaning that it is carried out with the intention of generating income from the sale of goods or services

- The activity must be conducted with a frequency and continuity comparable to similar activities carried out by for-profit organizations. Note that occasional or sporadic activities are generally not subject to UBIT

- The income-generating activity must not directly contribute to the fulfillment of the organization’s tax-exempt purpose, apart from the production of income itself

Specific examples which may include UBIT are:

- Income generated from the regular sale of goods or services that are not directly related to the organization’s exempt purposes may be considered UBIT. For example, plans that have pharmacies that provide over the counter medications.

- Income from selling advertising space in a publication, website, or other media platforms, if not substantially related to the organization’s exempt purpose.

- While passive income from investment funds is generally exempt from UBIT, income from the debt-financed investments (i.e., acquired with borrowed funds) may be subject to tax.

- Income derived from the use of property that is financed with borrowed funds and not substantially related to the organization’s exempt purpose.

- A tax-exempt organization’s share of ordinary business income from a partnership or S corporation engaged in unrelated business activities.

UBIT Exceptions and Recordkeeping

Some examples of income that are generally exempt from UBIT include:

- Dividends, interest, and annuities (subject to certain limits)

- Royalties

- Rent from real property (subject to certain conditions)

- Income from research activities

- Gains or losses from the sale of certain property

It is essential for tax-exempt organizations to carefully monitor their unrelated business activities and comply with UBIT requirements to maintain their tax-exempt status and avoid potential penalties. Proper recordkeeping is essential to ensure transparency, accountability, and the ability to respond to inquiries or audits by the Internal Revenue Service.

Recordkeeping requirements include:

- Financial records including income statements, balance sheets, and cash flow statements, to track unrelated business income and expenses. This includes records for gross receipts, sales invoices, expense receipts, canceled checks, and bank statements.

- Documentation of unrelated business activities that describes the nature, scope, and frequency of unrelated business activities, including details on how these activities are separate from the organization’s exempt purposes.

- Allocation of expenses between related and unrelated activities, including any methods or formulas used to allocate indirect costs.

- Payroll records, including timesheets or other documentation that indicates the portion of an employee’s time spent on unrelated activities.

- Partnership or S corporation records related to its share of income, deductions, and credits from such entities.

- Debt-financed investment funds or property records including documentation of the purchase, financing arrangements, and income and expenses related to the investment funds or property.

Organizations should retain copies of all filed Form 990-T returns and any supporting schedules, statements, or attachments, along with any correspondence with the IRS related to UBIT matters. The IRS generally requires organizations to keep records for at least three years from the date the return is filed or the due date of the return, whichever is later. However, if an organization understates its income by more than 25%, the record retention period extends to six years. In cases of fraud or if no return was filed, records should be kept indefinitely.

Deadlines, Extensions and Possible Penalties

The deadline for filing Form 990-T depends on the tax-exempt organization’s tax year. Most organizations operate on a calendar year basis with their tax year ending on December 31. For these organizations, Form 990-T must be filed by the 15th day of the 5th month following the end of the tax year. In this case, the deadline is May 15th of the following year. If the organization operates on a fiscal year basis, the deadline will be the 15th day of the 5th month after the fiscal year ends.

Tax-exempt organizations can request an automatic six-month extension to file Form 990-T by submitting Form 8868, Application for Extension of Time to File an Exempt Organization Return, by the original due date of Form 990-T.

There are potential penalties for late filing or not filing at all and include:

- A late filing penalty is generally 5% of the unpaid tax for each month (or part of a month) the return is late, up to a maximum of 25% of the unpaid tax.

- The minimum penalty is the lesser of $450 or 100% of the tax due.

- A failure to pay taxes is typically 0.5% of the unpaid tax for each month (or part of a month) the tax remains unpaid, up to a maximum of 25% of the unpaid tax.

- In addition to the financial penalties, consistently failing to file Form 990-T or not paying the UBIT may result in the revocation of the organization’s tax-exempt status by the IRS.

To avoid these penalties and maintain their tax-exempt status, organizations should file Form 990-T by the applicable deadline and pay any taxes owed on time.

- A failure to pay penalty is typically 0.5% of the unpaid tax for each month (or part of a month) the tax remains unpaid, up to a maximum of 25% of the unpaid tax.

- In addition to the financial penalties, consistently failing to file Form 990-T or not paying the UBIT may result in the revocation of the organization’s tax-exempt status by the IRS.

To avoid these penalties and maintain their tax-exempt status, organizations should file Form 990-T by the applicable deadline and pay any taxes owed on time.

Offsetting UBIT Losses

A nonprofit organization can offset unrelated business income with losses from other unrelated business activities when filing IRS Form 990-T. This is done by netting the gains and losses from all unrelated business activities.

If an organization has multiple unrelated business activities, it should calculate the income and deductions for each activity separately. Once the net income or loss from each activity is determined, the organization can combine the results to arrive at its total unrelated business taxable income.

If the total net income from all unrelated business activities is positive, the organization will owe Unrelated Business Income Tax (UBIT) on that income. If the total net income is negative, the organization has a net operating loss (NOL) for the tax year. Under the current tax law, NOLs arising in tax years beginning after December 31, 2017, can be carried forward indefinitely but cannot be carried back. The NOL can offset up to 80% of the organization’s unrelated business taxable income in future years.

Why Choose Us?

With offices from coast to coast, 5500Tax Group’s exclusive focus is on employee benefit tax compliance issues and regulatory changes. As highly qualified CPAs in good standing with decades of experience, our team of experts is well-versed in the latest regulatory reporting requirements and is dedicated to providing you with comprehensive and accurate Form 990-T preparation.

Our commitment to you is accuracy, timeliness, and customer satisfaction which ensures that your filing experience is as seamless as possible. Click here to learn more.

Contact us today to learn more about how we can assist you with your IRS Form 990-T and UBIT needs!