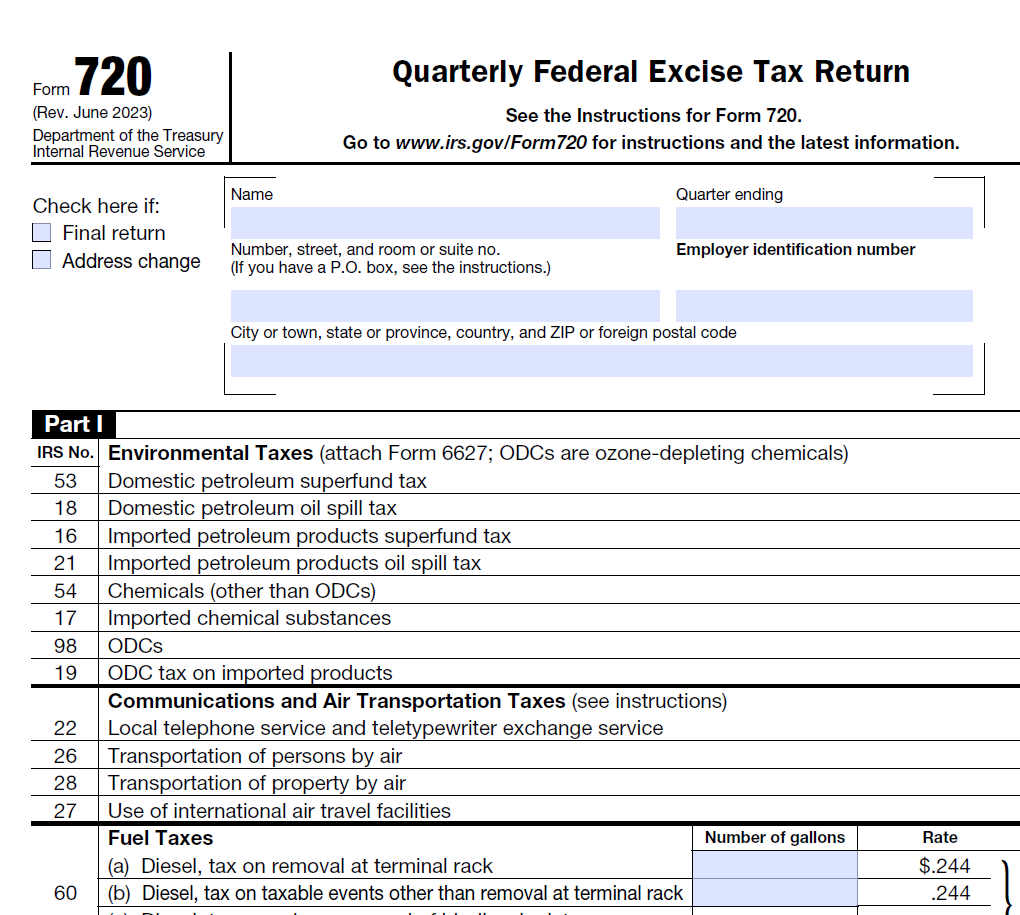

In a broad scope, Form 720 is a quarterly excise tax return that businesses must file to report and pay federal excise taxes on certain products or services. The form is typically filed by manufacturers, retailers, and other businesses that deal with products such as alcohol, tobacco, firearms, gasoline, and other fuel-related products. Additionally, Form 720 is used to report other tax liabilities, such as the Health Insurance Providers Fee, which is applicable to certain health insurance issuers.

However, specifically related to employee benefits, the form includes the Patient-Centered Outcomes Research Institute (PCORI) fee, which was enacted by the Affordable Care Act. This fee is imposed to fund research that helps patients, clinicians and policymakers make informed healthcare decisions.

Fully Insured Plans vs. Self-Insured Plans

Both fully insured plans and self-insured plans are subject to the PCORI fee, but the responsibility for paying the fee and filing the associated IRS Form 720 differs between the two types of plans.

For fully insured health plans, whereby the employer contracts with an insurance company to provide health insurance for their employees, the insurance company is the entity responsible for paying the PCORI fee. The insurance company calculates the fee based on the average number of participants covered under the plan during the plan year.

For self-insured health plans, also known as a self-funded plan, the employer assumes the financial risk of providing healthcare benefits to their employees instead of contracting with an insurance company to manage and pay for healthcare services. In this case, the plan sponsor, typically the employer, is responsible for paying the PCORI fee. Likewise, the plan sponsor must calculate the fee based on the average number of participants covered under the plan during the plan year.

Approved Methods of Filing

Plan sponsors and issuers can use one of three methods to determine the average number of lives (participants) covered:

- Form 5500 method: This method involves using the information reported on the plan’s most recently filed Form 5500 to calculate the average number of participants covered. Note that if the plan is not required to file a Form 5500, this method cannot be used.

- Snapshot method: This method involves taking a snapshot of the number of covered participants on one day of the 1st, 2nd and 3rd month in each quarter of the plan year, and then calculating the average number of covered participants based on these snapshots.

- Snapshot factor method: This method is similar to the Snapshot method, but the number of lives covered other than “self-only coverage” on any date is multiplied by a factor of 2.35.

- Count method: This method involves calculating the total number of participants covered for each day of the plan year and then dividing this total by the number of days in the plan year.

Who Must File and What is the Timing?

Small businesses, plan sponsors, and issuers of applicable self-insured health plans or insured health plans are required to file Form 720 and pay the PCORI fee.

While the fee is a separate fee from the excise taxes reported on Form 720, the PCORI fee is also reported on Form 720, Part II, along with other fees and taxes. Therefore, if your business is required to pay the PCORI fee, you will need to include it on your quarterly Form 720.

Whether the insurance company or the plan sponsor is responsible, either must file the IRS Form 720 using the second quarter form and pay the fee annually by July 31st for the plan years ending in the preceding calendar year.

The PCORI rate is adjusted annually, effective October 1st of each year.

Benefits of a Preparation Service

It’s important to note that not all health plans are subject to the PCORI fee, and the fee rates and reporting requirements can vary from year to year. Therefore, it’s a good idea to consult with a tax professional or accountant to ensure that you’re meeting all the necessary requirements related to the PCORI fee and Form 720 reporting.

Why Choose Us?

With offices from coast to coast, 5500Tax Group’s exclusive focus is on employee benefit tax compliance issues and regulatory changes. As highly qualified CPAs in good standing with decades of experience, our team of experts is well-versed in the latest regulatory reporting requirements and is dedicated to providing you with comprehensive and accurate Form 720 preparation.

Our commitment to you is accuracy, timeliness, and customer satisfaction which ensures that your filing experience is as seamless as possible. Click here to learn more.

If you have a self-insured plan and are required to complete the form, we can help!