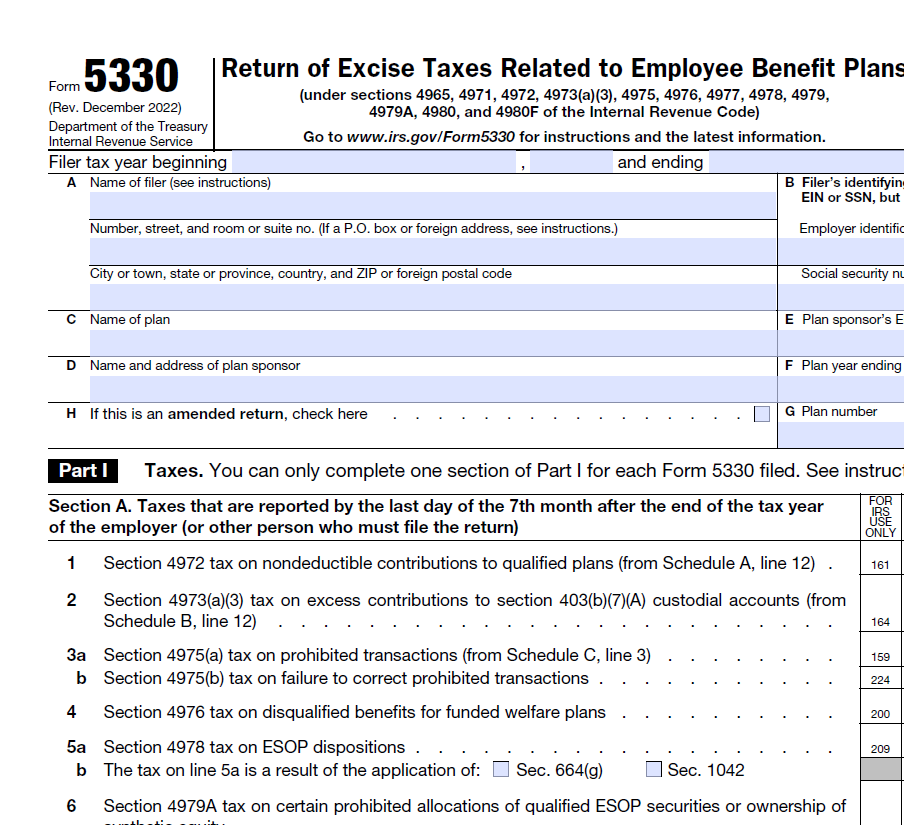

Form 5330 is a tax form used in the United States to report excise taxes on certain transactions and operations within employee benefit plans. This form is filed by the plan sponsor or employer and is commonly associated with retirement plans, such as 401(k) and other qualified pension plans.

It is worth noting that in the past 403(b) plans were not subject to the rules associated with Form 5330, but with recent tax law changes, they now are. These types of tax advantaged retirement plans are available to employees of public schools, certain tax-exempt organizations and certain ministers.

Proper preparation and compliance with Form 5330 is essential for plan sponsors to avoid penalties and ensure the smooth operation of their employee benefit plans.

Form 5330 can now be filed electronically.

Key Aspects to Consider

Not all employee benefit plans require the filing of Form 5330. The form is used to report excise taxes on the following:

- Prohibited transactions such as an improper loan between the plan and a disqualified person, for example a plan fiduciary, service provider (e.g., attorney or accountant), employer, officer, owner or a family member. Additionally, a late deposit of employee contributions is also considered an improper loan. *

- Funding deficiencies which occur when the plan’s assets are insufficient to cover its liabilities

- Nondeductible/excess contributions which happens if a 403(b) plan receives nondeductible contributions that exceed the limits set by the Internal Revenue Code.

- Late funding of minimum required contributions if a 403(b)-plan sponsor fails to make minimum required contributions to the plan on time.

- Excess fringe benefits specifically known as “qualified transportation fringe benefit plans” that allow employers to provide transportation benefits to employees on a tax-free basis, but only up to certain limits established by the IRS Code.

- Reversion of qualified assets which occurs when assets from a qualified retirement plan are returned to the employer upon the termination of the plan or under other certain circumstances, like amending the plan to reduce or reallocate plan assets back to the employer.

You must carefully review your plan’s transactions during the year to identify any taxable events that require reporting on Form 5330.

* Prohibited transactions related to late deposit of employee contributions that are not fully corrected will have to file and pay excise taxes in the subsequent plan years. Full correction of late employee contribution must include depositing lost earnings on the late contributions into the employee benefit plan.

What is the Deadline and Are There Penalties?

The deadline for filing Form 5330 depends on the type of excise tax being reported. Generally, the form must be filed by the last day of the seventh month after the end of the plan’s tax year, which is usually July 31 for calendar-year plans. However, the due date may vary depending on the specific excise tax involved. It is essential to consult the Form 5330 instructions or a tax professional to determine the appropriate deadline for your specific situation.

If you need additional time to file Form 5330, you can request an extension by filing Form 5558, “Application for Extension of Time to File Certain Employee Plan Returns.” This form should be submitted before the original due date of Form 5330. If an extension is granted, it generally provides an additional six months to file the form. Please note that an extension of time to file is not an extension of time to pay any excise tax due. You are still required to pay the tax by the original due date to avoid potential penalties and interest.

Failing to file Form 5330 can result in various consequences:

- If you fail to file Form 5330 by the due date (including any approved extensions), you may be subject to a penalty equal to 5% of the unpaid excise tax for each month or part of a month that the form is late, up to a maximum of 25% of the unpaid tax.

- If you fail to pay the excise tax by the due date, a penalty equal to 0.5% of the unpaid tax per month or part of a month may apply, up to a maximum of 25% of the unpaid tax. This penalty is in addition to the late filing penalty mentioned above.

- If you fail to pay the excise tax on time, interest will be charged on the unpaid tax from the due date until the tax is paid in full. The interest rate is determined quarterly by the IRS and is subject to change.

- Failure to file Form 5330 or pay the excise tax may attract the attention of the IRS, potentially leading to audits, inquiries, or further enforcement actions. This can result in additional penalties, taxes, and potential legal issues.

- In some cases, failure to file Form 5330 and pay the excise tax may lead to a loss of tax benefits associated with the retirement plan or other employee benefit plans. This can have negative consequences for both the employer and the plan participants.

If you discover errors on a previously filed Form 5330, you can correct them by filing an amended form. It is essential to file an amended return as soon as you become aware of the errors on the previously filed 5330. Correcting errors in a timely manner can help minimize potential penalties, interest charges, and other consequences associated with inaccurate filings.

It is highly recommended to consult with a tax professional when preparing an amended return to ensure accuracy and compliance with all applicable rules and regulations.

Common Errors and How to Avoid Them

Common errors can include a variety of things such as missing or incorrect information, incomplete or unclear explanations, incorrect tax calculations or generally not filing the form when required.

To avoid these common mistakes, follow these best practices:

- Stay informed about filing requirements and applicable regulations.

- Develop and maintain internal controls to ensure accurate record-keeping and reporting.

- Consult with a tax professional to ensure compliance with filing requirements and other applicable rules and regulations.

- Review your plan’s operations regularly to identify potential excise tax issues and take corrective actions as needed.

- Train personnel responsible for managing and administering the retirement or employee benefit plan to ensure they are knowledgeable about the applicable rules and regulations.

Benefits of a Preparation Service

Working with a tax professional can provide a variety of benefits for businesses, especially when navigating complex tax situations. They include:

- Experience and knowledge

- Time-savings

- Minimizing errors

- Tax planning optimization

- Representation for tax authorities, if required

Overall, this can give you peace of mind, reduce stress and confidence that your tax affairs are being managed correctly and efficiently.

Why Choose Us?

With offices from coast to coast, 5500Tax Group’s exclusive focus is on employee benefit tax compliance issues and regulatory changes. As highly qualified CPAs in good standing with decades of experience, our team of experts is well-versed in the latest regulatory reporting requirements and is dedicated to providing you with comprehensive and accurate Form 5330 preparation.

Our commitment to you is accuracy, timeliness, and customer satisfaction which ensures that your filing experience is as seamless as possible. Click here to learn more.

Contact us today and let us help you work through the intricacies of Form 5330!