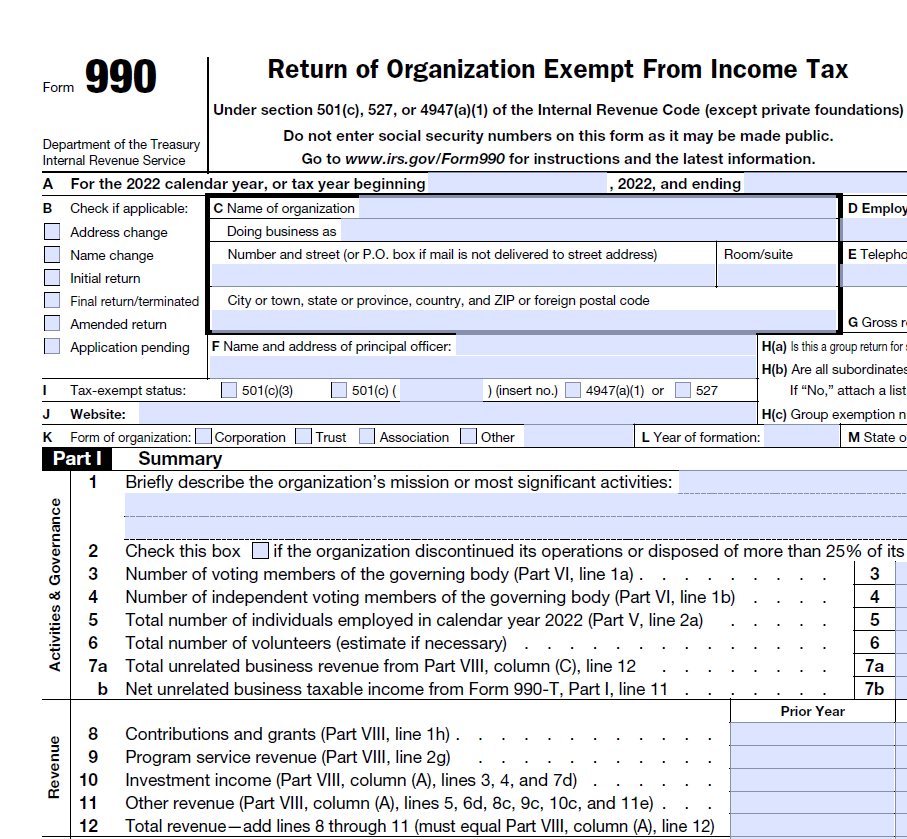

Form 990, Annual Exempt Organization Return, is an annual information return filing that tax-exempt organizations in the United States must file with the Internal Revenue Service (IRS). This form provides information about the organization’s finances, including its income, expenses, assets, and liabilities as well as program services.

It is important to note that this form is NOT used to calculate taxes owed by the organization. On the other hand, Form 990-T is a separate tax form that must be filed by tax-exempt organizations that have certain types of unrelated business income and is used to calculate and report tax owed. You can learn more here.

To accurately file this form, organizations must maintain detailed financial records throughout the year to ensure that the information provided on Form 990 is complete and accurate. This includes tracking income from contributions, program service revenue and other sources, as well as recording expenses for benefits paid to or for members, salaries, supplies, and other operational costs.

In addition to identifying all the activities that qualify you for tax exempt status, including tax-exempt activities, benefit programs and other types of public service, it’s important to disclose any potential conflicts of interest involving board members and key personnel.

Preparation Services We Offer

Form 990 preparation requires careful attention to detail and a thorough understanding of accounting principles and practices. Organizations may choose to work with a qualified accountant or tax professional to ensure that the form is completed accurately and in compliance with all relevant regulations and requirements.

Common Errors Include:

- Failing to provide complete and accurate information which can result in delays, penalties or even the loss of tax-exempt status

- Not attaching the required schedules

- Reporting incorrect compensation information

- Failing to disclose potential conflicts of interest

As CPAs and with our knowledge and experience we can help you sort through the details needed to successfully file the form.

When Must Form 990 Be Filed?

The form must be filed on an annual basis, typically by the 15th day of the 5th month after the end of the organization’s tax year. Failure to file Form 990 can result in penalties and the loss of tax-exempt status for the organization.

Voluntary Employee’s Beneficiary Association (VEBA)

VEBA is a tax-exempt trust established by employers or a group of employees to cover certain welfare benefit expenses of its members. The VEBA is a convenient way to segregate plan assets from employer’s general assets to fund welfare benefit plans such as health, life and disability. There is certain additional information related to the operations of the VEBA that must be reported on the Form 990.

Form 5500 Details

Complexity and Challenges – We Have You Covered

Preparing Form 990 for exempt organizations can be a complex and challenging process. Here are a few common challenges that preparers may face, along with some tips for addressing them:

- Gathering complete and accurate information: This may involve coordinating with multiple departments or individuals and ensuring that all financial and organizational information is properly documented. To address this challenge, we establish clear processes for gathering information and ensuring that it is accurate and complete

- Complex tax laws and regulations are difficult to interpret. We keep up to date with changes through continuing professional education

- Meeting filing deadlines: We will establish clear processes and timelines for preparing and filing the form and use electronic filing options to ensure timely submission

By addressing these common challenges and implementing effective processes and procedures, we help ensure a successful filing and maintain their organization’s tax-exempt status.

Why Choose Us?

With offices from coast to coast, 5500Tax Group’s exclusive focus is on employee benefit tax compliance issues and regulatory changes. As highly qualified CPAs in good standing with decades of experience, our team of experts is well-versed in the latest regulatory reporting requirements and is dedicated to providing you with comprehensive and accurate Form 990 preparation.

Our commitment to you is accuracy, timeliness, and customer satisfaction which ensures that your filing experience is as seamless as possible. Click here to learn more.

Contact us today to learn more about how we can assist you with your Form 990 and put your mind at ease!