Form 8955-SSA is an annual report filed by employers to report information about separated participants with deferred vested benefits under their retirement plans. The purpose in filing the form is to report information about a separated participant to the Social Security Administration (SSA), so that the SSA can notify the separated participants of their potential retirement benefits when they become eligible for Social Security.

To complete the form accurately the needed information includes documentation about the Plan Sponsor, the Plan Administrator, the Plan Year along with the total number of participants with deferred vested benefits and specific information about each participant.

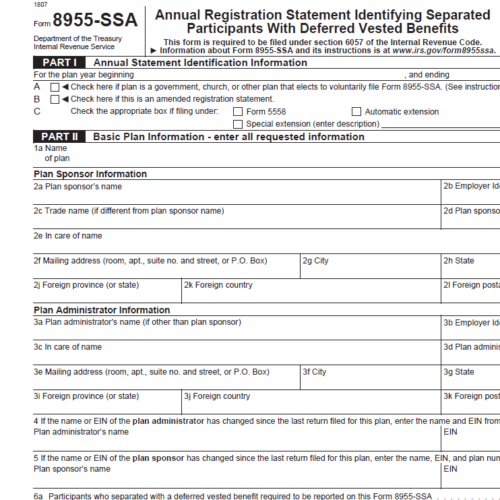

The form consists of two parts:

- Part 1 includes information about the Plan and the Plan Sponsor

- Part 2 includes information about Deferred Vested Participants

It’s important to note that Form 8955-SSA must be filed electronically unless you have received a waiver from the IRS. The form is filed using the IRS’s FIRE (Filing Information Returns Electronically) system or a third-party software provider that is approved by the IRS.

Who Must File Form 8955-SSA?

Form 8955-SSA is required to be filed by plan administrators or plan sponsors of certain retirement plans subject to the Employee Retirement Income Security Act (ERISA).

These plans typically include:

- Defined benefit pension plans

- Defined contribution plans, such as 401(k) plans, profit-sharing plans, and stock bonus plans

- 403(b) plans for non-profit organizations

- Certain 457(b) plans for governmental and non-governmental entities

The form must be filed for any plan year in which one or more participants, separated in the previous plan year, has deferred vested benefits under the plan at the end of the current plan year. Multiple employer plans would report a participant that incurs two successive 1-year breaks in service and has deferred vested benefits. If you are a plan administrator or plan sponsor of a retirement plan subject to ERISA and have separated participants with deferred vested benefits in the plan, you are required to file Form 8955-SSA.

Timing and Deadlines

The deadline for filing is the last day of the seventh month following the end of the plan year. You can apply for a 2.5-month extension by filing Form 5558, Application for Extension of Time to File Certain Employee Plan Returns.

To avoid penalties, it is crucial to file Form 8955-SSA on time, accurately, and with complete information. Failure to file penalties can be severe. There are three possible penalties related to the Form 8955-SSA:

- Failure to file an annual registration statement: The IRS can impose a penalty of $10 per participant for each day the form is not filed, up to a maximum of $50,000

- Failure to file notification of a change in the status of the plan: The penalty for failure to file a notification of a change in the status of the plan, termination of the plan, or a change in the name or address of the plan administrator is $10 for each day such failure occurs, up to a maximum of $10,000.

- Failure to furnish statement ot plan participant or fraudulent statement: A penalty of $50 is imposed for each willful failure to furnish the statement to each participant or a willful furnishing of a false statement.

Differences from Form 5500

Keep in mind that Form 8955-SSA is specifically for reporting separated participants with deferred vested benefits in retirement plans, while Form 5500 is a more comprehensive annual report for all types of employee benefit plans, covering financial, participant, and operational information.

Both forms are filed annually and have similar deadlines, but they are submitted to different agencies and through different electronic systems.

Are There Situations Where Form 8955-SSA Does Not Need

to be Filed?

Yes!

- If there are no separated participants with deferred vested benefits under the plan during a specific plan year, there is no requirement to file for that year

- If the plan is not subject to the Employee Retirement Income Security Act (ERISA), such as certain church plans or non-ERISA 457(b) plans, there may be no requirement to file

- If the plan has been terminated and all benefits have been distributed to the participants, including the separated participants with deferred vested benefits, there is no requirement to file for subsequent plan years.

- One-participant retirement plans: These plans, also known as solo 401(k) or individual 401(k) plans, cover only the business owner (and their spouse, if applicable) and have no other employees. In general, these plans filing are not required.

It is essential to consult the Form 8955-SSA instructions, relevant IRS guidance, and your plan documents to determine if you are required to file Form 8955-SSA. If you are unsure about your filing requirements, consider seeking professional advice from a retirement plan expert or tax advisor.

Maintaining Accurate Records and Ensuring

Data Privacy

It is important that you maintain accurate records in case of a compliance audit by the IRS, the need to correct errors or if there are participant inquiries. Additionally, it is important to store these records securely to protect sensitive participant information and ensure data privacy. You should also consider developing a comprehensive record retention policy that includes guidelines for maintaining and eventually disposing of records related to Form 8955-SSA and other employee benefit plan documents.

A Benefit Plan Administrator should retain records related to Form 8955-SSA for a minimum of six years following the date the form is filed. This is in line with the general record retention guidelines for employee benefit plans as stated in ERISA regulations.

Why Choose Us?

With offices from coast to coast, 5500Tax Group’s exclusive focus is on employee benefit tax compliance issues and regulatory changes. As highly qualified CPAs in good standing with decades of experience, our team of experts is well-versed in the latest regulatory reporting requirements and is dedicated to providing you with comprehensive and accurate Form 8955-SSA preparation.

Our commitment to you is accuracy, timeliness, and customer satisfaction which ensures that your filing experience is as seamless as possible. Click here to learn more.

Contact us today and let us help you work through the intricacies of Form 8955-SSA!